san francisco sales tax rate history

The December 2020. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

The County sales tax rate is 025.

. Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625. And 075 if value is 1000000 or higher. 068 if value is between 250000 and 1000000.

The San Francisco Tourism Improvement District sales tax has been. Tax rate for nonresidents who work in San Francisco. City Rate County American Canyon 7750.

8 Parking Tax. The average sales tax rate in California is 868. 1000000 or more but less than 5000000.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. Anaheim 7750 Orange Anderson 7750. The highest sales tax in the state is Santa Fe Springs a LA County city with a rate of 1050 percent.

The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. Type an address above and click Search to find the sales and use tax rate for that location. The tax rate given here will reflect the current rate of tax for the address that you enter.

To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Rate changed to 14 effective August 1996. The San Francisco sales tax rate is 0.

Select the California city from the list of cities starting with A below to see its current sales tax rate. Presidio San Francisco 8625. Did South Dakota v.

7 Hotel Tax. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. 4 rows The current total local sales tax rate in San Francisco CA is 8625.

Average Sales Tax With Local. City of South San Francisco Sales Tax Measure W November 2015 San Mateo County. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

The Bradley-Burns Uniform Local Sales and Use Tax Law was. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

The San Francisco County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. This is the total of state county and city sales tax rates. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

375 for each 500 or portion thereof. 5 digit Zip Code is required. 05 if sale value is less than 250000.

You can print a 9875 sales tax table here. For tax rates in other cities see. The California sales tax rate is currently 6.

More than 100 but less than or equal to 250000. The transfer tax rate had been previously unchanged since 1967. Next to city indicates incorporated city City.

340 for each 500 or portion thereof. Scroll below to view historical statewide sales tax propositions. Effective 101594 rates were.

Angels Camp 7250 Calaveras. There have been 72 local sales tax rate changes in California. 5000000 or more but less than 10000000.

With local taxes the total sales tax rate is between 7250 and 10750. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note.

Proposition 172 1993 extended the state sales tax rate of 6 percent. Please ensure the address information you input is the address you intended. Rate County Acampo.

What is the sales tax rate in San Francisco California. San Francisco Tourism Improvement District. 6 Real Property Transfer Tax.

The statewide sales tax in California was first imposed on August 1 1933 at the rate of 250 under the Retail Sales Act of 1933 No local sales taxes were levied at that time. The minimum combined 2022 sales tax rate for San Francisco California is 863. San Franciscos taxable online sales were up only 1 in that three-month period compared to the same period a year ago while other California cities saw gains over 10 as people ordered more.

More than 250000 but less than 1000000. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. 250 for each 500 or portion thereof.

Presidio of Monterey Monterey 9250. Historical Tax Rates in California Cities Counties. California has recent rate changes Thu Jul 01 2021.

States With Highest And Lowest Sales Tax Rates

California Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

California Taxpayers Association California Tax Facts

Understanding California S Property Taxes

Did The Last Labour Governments Really Hike Taxes By 1 895 A Year General Election 2015 The Guardian

Frequently Asked Questions City Of Redwood City

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Most And Least Tax Friendly Major Cities In America

Sales Tax Collections City Performance Scorecards

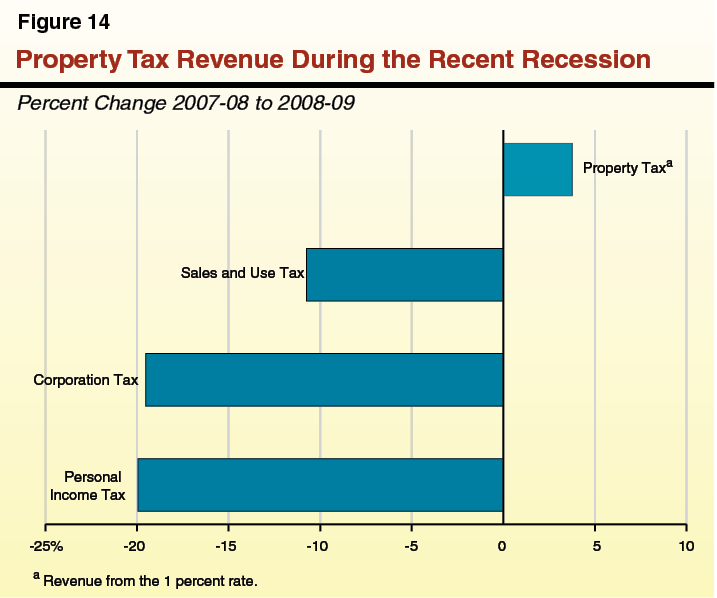

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

Opinion Why California Worries Conservatives The New York Times

Understanding California S Property Taxes

How Do State And Local Sales Taxes Work Tax Policy Center